content

Domestic Fixed Income

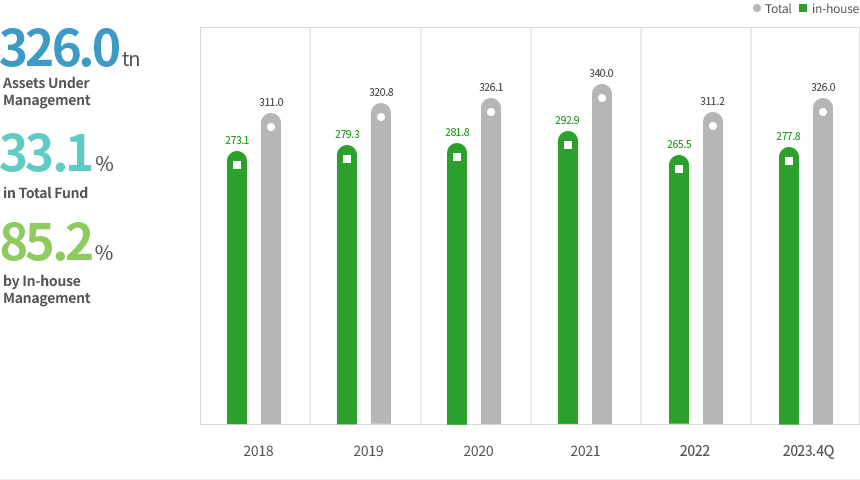

The NPS seeks to maximize sustained long-term returns by holding bonds until their maturity and diversifying investments by type, issuer, industry (for corporate bonds) and maturity. In this process, the NPS pursues excess returns by adjusting duration within a certain range in consideration of several factors including credit ratings of issuers and spread over risk-free bonds.

Overview

(in trillion won, as of the end of Q4 in 2023)

Asset Value Of the Domestic Fixed-income 326.0, Weight in the Total Fund 33.1%, In-house Management Portion of the Domestic Fixed-income 85.2%

| year | In-house | Total |

|---|---|---|

| 2018 | 273.1 | 311.0 |

| 2019 | 279.3 | 320.8 |

| 2020 | 281.8 | 326.1 |

| 2021 | 292.9 | 340.0 |

| 2022 | 265.5 | 311.2 |

| 2023. 4Q | 277.8 | 326.0 |

- Until a fund management assessment is completed, preliminary estimates are provided.

- The figures above might not add up due to rounding.

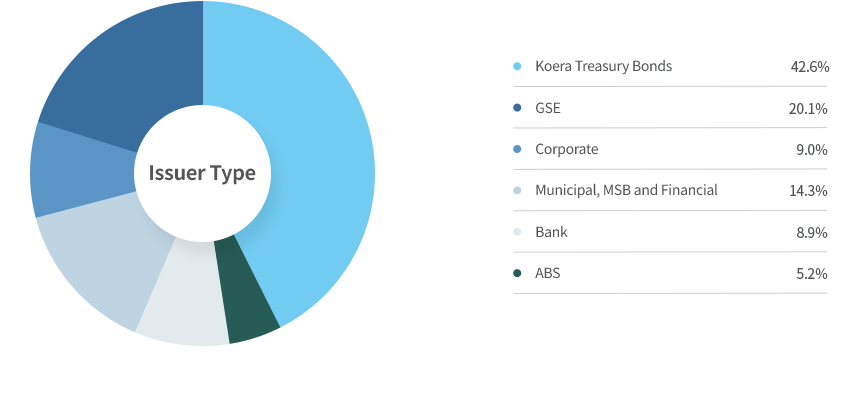

Sector Composition

(As of the end of Q4 in 2023)

- Korea Treasury Bonds 42.6%

- GSE 20.1%

- Corporate 9.0%

- Municipal, MSB and Financial 14.3%

- Bank 8.9%

- ABS 5.2%

The figures above provide a breakdown per issuer type as of the end of each quarter.

Top10 Holdings

(in 100 million won, as of the end of 2022)| No. | Issuer | Amount | Weight |

|---|---|---|---|

| 1 | Korea Treasury Bonds | 1,296,198 | 43.7% |

| 2 | Korea Housing Finance Corporation | 246,484 | 8.3% |

| 3 | Korea Electric Power Corporation | 134,049 | 4.5% |

| 4 | Bank of Korea | 131,974 | 4.4% |

| 5 | Korea Lands and Housing Corporation | 49,864 | 1.7% |

| 6 | Seoul Metropolitan Government | 31,482 | 1.1% |

| 7 | National Agricultural Cooperative Federation | 29,338 | 1.0% |

| 8 | Korea Development Bank | 26,287 | 0.9% |

| 9 | Industrial Bank of Korea | 21,965 | 0.7% |

| 10 | Nonghyup Bank | 21,803 | 0.7% |

Data on assets by sector, geography, issuer or type as of the end of the fiscal year is disclosed in the third quarter of the following year according to Article 25 of the Guideline for National Pension Fund Management and Article 39 of the Regulation on National Pension Fund Management.